Invest In Exclusive

Corporate Bonds

[Not Available To The Public]

Bonds has outperformed the S&P every year for 20 years

Off-Market Bonds Deals Not Available to the Public

Diversify your 401(k) with high-yield corporate bonds [ Up to 14% Returns]

Baluch Capital Has Never Lost Investor Capital

Why Invest in Corporate Bonds?

Diversify

Diversify and temper risk by investing in corporate bond

De-Risk

Bonds: Low-risk lighthouse in the tempest of equities.

Beat Inflation

Beat Inflation, Protect your Wealth

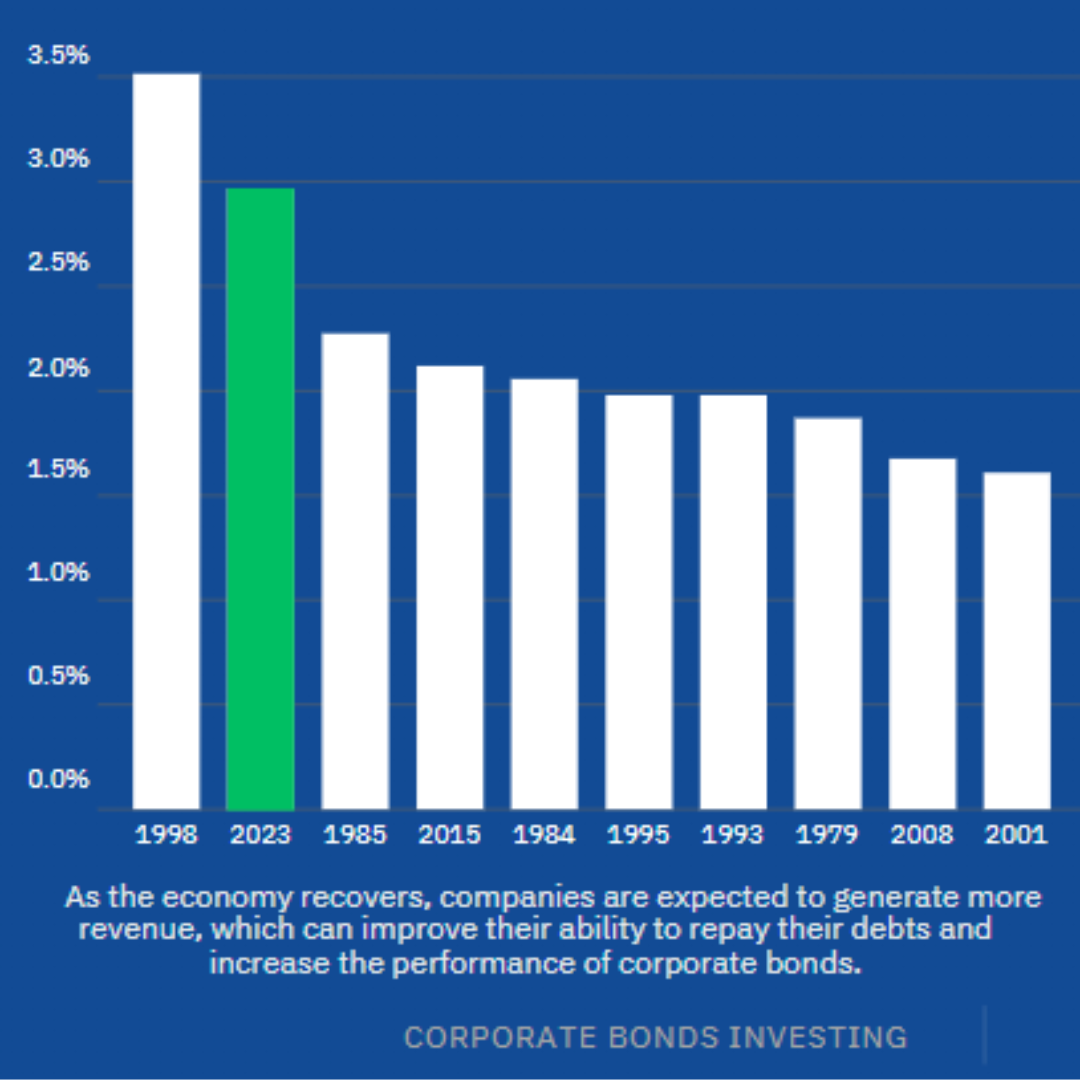

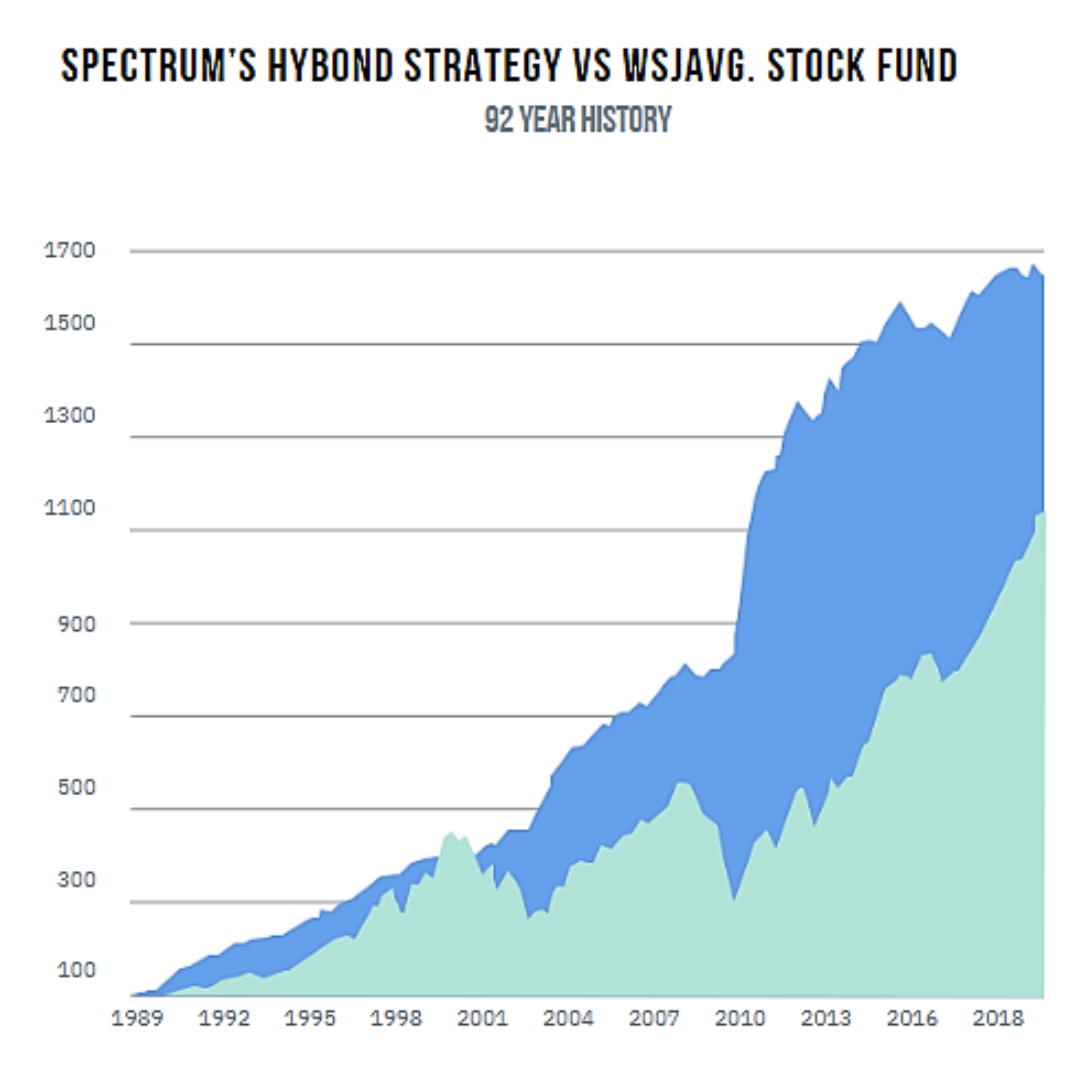

Corporate Bonds VS Stock Fund

HOW IT WORKS

OUR UNIQUE MARKET EDGE

We have access to Corporate Bonds opportunities not available to the public.

We invest inInitial Bond Issuances and yield-to-cost ratio which gives us the most returns per dollar invested.

We offers returns 14% annually, which isn’t possible with public stocks.

Our deals are extensively vetted with months of due diligence.

Our founder has an extensive investment background and 11 years of experience in investing.

Tax codes IRC 1202 and 1045 may help prevent capital gains tax.

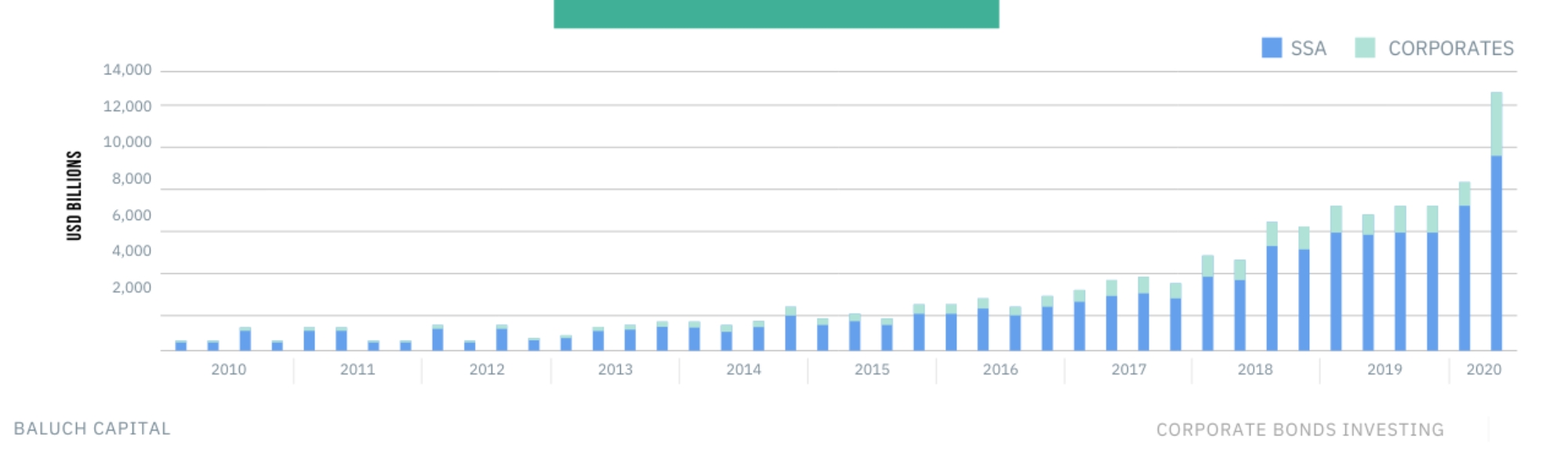

HOW BIG IS THE CORPORATE BOND MARKET?

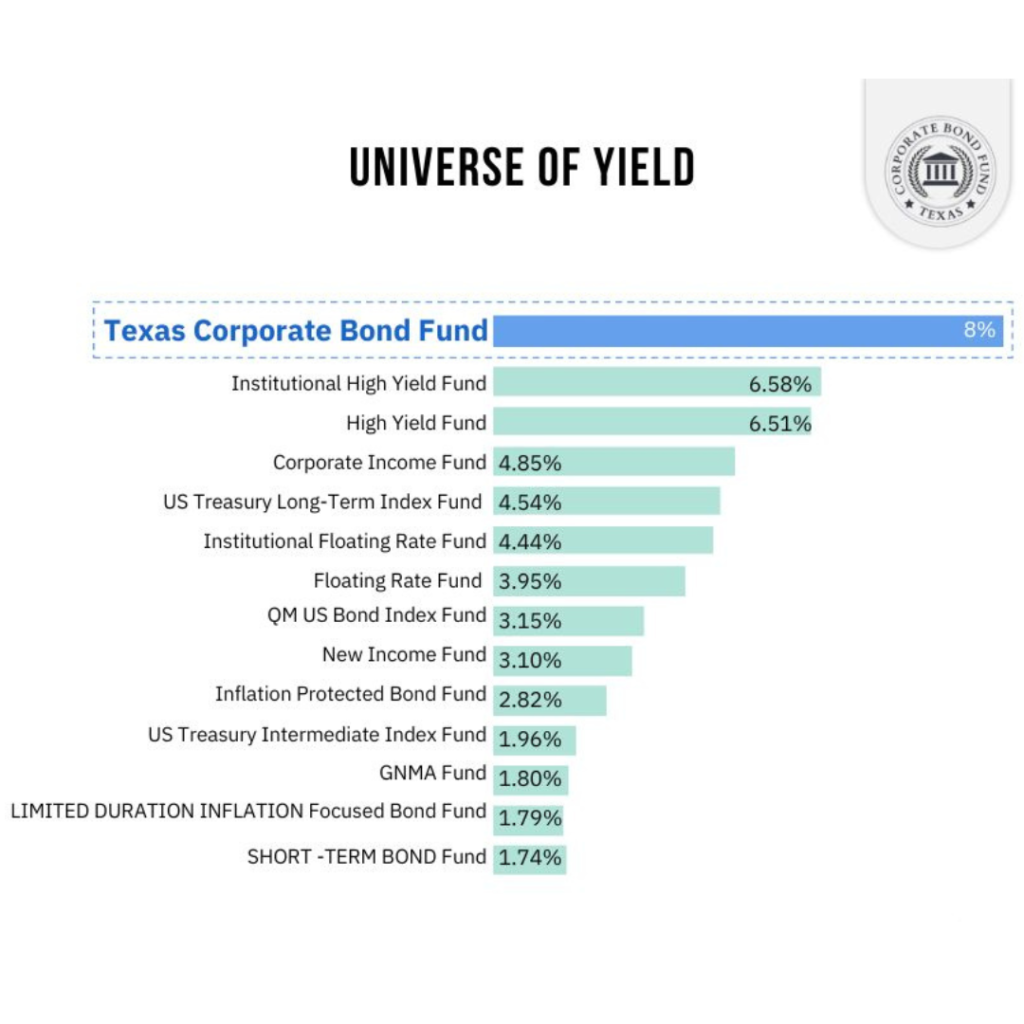

YIELD +

STABILITY

Baluch capital group offers superior stability and is one of the top yield products on the market today

MEET THE

FOUNDER

Nine years of experience in private equity and securities with series 22 and 63, four years under Broker/Dealer, where he learned to evaluate risk, opportunity, diversification, and underwriting.

Internationally best-selling author of wealth management and investment book “Make It, Keep It.”

Managed or participated in over 80 investment projects, over $500M in value, with zero loss of any investor capital

MEET THE

FOUNDER

Nine years of experience in private equity and securities with series 22 and 63, four years under Broker/Dealer, where he learned to evaluate risk, opportunity, diversification, and underwriting.

Internationally best-selling author of wealth management and investment book “Make It, Keep It.”

Managed or participated in over 80 investment projects, over $500M in value, with zero loss of any investor capital

Apply to

Invest With US

frequently asked

questions

How does a Texas Corporate Bond work?

When a corporation issues a Texas Corporate Bond, it sets an interest rate and a maturity date. Investors who purchase these bonds lend money to the company and receive interest payments at regular intervals until the bond matures. At maturity, the company repays the principal amount to the bondholders.

What is the minimum investment required for Texas Corporate Bonds?

The minimum investment required to purchase Texas Corporate Bonds can vary depending on the specific bond offering and the financial institution facilitating the purchase. Some bonds may have minimum denominations, while others may have no minimum investment requirement. It is advisable to check with the broker or financial institution for specific details.

Can Texas Corporate Bonds be held in tax-advantaged accounts?

Yes, it is possible to hold Texas Corporate Bonds within tax-advantaged accounts such as Individual Retirement Accounts (IRAs) or 401(k) plans, subject to the account’s specific rules and regulations. Investing in tax-advantaged accounts can provide potential tax benefits, such as deferral of taxes on interest income or capital gains. It is recommended to consult with a tax professional to understand the tax implications and benefits.

Are Texas Corporate Bonds suitable for income-oriented investors?

Yes, Texas Corporate Bonds are often considered suitable for income-oriented investors. These bonds typically offer regular interest payments, which can serve as a stable source of income for investors seeking consistent cash flow. However, it is essential to assess the creditworthiness of the issuing company and the overall risk-return profile before investing.

SCHEDULE A FREE STRATEGY CALL